Another Look At The New Interconnected Instability Era: Integrating Demography Into The Narrative

“The rise in China and demography created a ‘sweet spot’ that has dictated the path of inflation, interest rates, and inequality over the last three decades. But the future will be nothing like the past….and we are at a point of inflection. As the sweet spot turns sour, the multi-decade trends that demography brought about are set for a dramatic reversal.”

From “The Great Demographic Reversal”A new book by Charles Goodhart and Manoj Pradham

Demographic Insights into the Interconnected Instability Era

The October 2022 Letter asserted that the benign investment environment that followed the 2008 Global Financial Crisis had ended, and that a new, less friendly investment environment we dubbed the Interconnected Instability Era had begun. This new era has interconnected physical (e.g., climate-related) and social (e.g., health and conflict-related) dimensions of instability, giving rise to the term ‘polycrisis’. The follow-on November 2022 Letter argued that investment strategies ‘adaptive’ to these new realities would have the best chance of succeeding in the decade ahead and beyond.

Then came a recommendation that I should read “The Great Demographic Reversal”, the source of the opening quote above. It offers a strong reminder that demography is indeed still destiny, making the case that any plausible socio-economic description of the coming decade and beyond must address the predictable demographic challenges we will be facing. Here is the essence of the Goodhart-Pradham story which went to press at the start of the COVID pandemic in early 2020:

- The entry of the outsized Boomer Generation and the rise of China combined to create the largest-ever global labour supply shock. Aided by trade globalization, these demographic drivers largely explain the deflationary environment of the last three decades.

- The principal beneficiaries of this labour supply shock were capital owners and Chinese workers.

- These deflationary drivers are now reversing. Working-age populations in the developed world are now shrinking and trade is deglobalizing, leading to rising inflationary pressures and moderating growth prospects into the indefinite future. Higher inflation rates lead to higher nominal interest rates. Real rates will also be higher as investment-related funding demands outstrip the savings rates of shrinking workforces. The finance, health care, and pensions sectors will all be materially impacted by these reversals, as will government finances.

- Can these supply-driven inflationary pressures and savings shortfalls be mitigated? Two levers are 1. extending working lives and 2. raising capital intensity and productivity especially in the health care sector. These solutions tie in directly with the need to raise the volume and positive impact of retirement savings. The authors argue that both solutions will be challenging to implement. For many workers, historically-established retirement ages continue to be sacrosanct despite people living longer lives. On the productivity front, the authors question the effectiveness of corporate governance in raising the real return on corporate capital in the current decade and beyond.

How to integrate these insights into the Interconnected Instability Era narrative? That is the question we turn to next.

Rewriting the Interconnected Instability Era Narrative

The October 2022 Letter used the following basis for introducing the Interconnected Instability Era narrativei:

- Humanity is facing an array of grave, long-term challenges, now often labelled ‘global systemic risks’. While we know a lot about the individual causes of these crises, our understanding of the causal links between them remains shallow.

- What causal processes might be accelerating, amplifying, and synchronizing these risks within global natural and social systems? Two obvious candidates are 1. The growth in scale of humanity’s resource consumption and pollution output, and 2. The vastly greater connectivity between human systems permitting higher volume and velocity of long-distance flows of goods and information.

- Addressing the ‘causal processes’ question leads to the concept of a ‘global polycrisis’: a single macro crisis of interconnected, runaway failures of Earth’s vital natural and social systems that irreversibly degrades humanity’s prospects.

The Letter provided two illustrations of how feedback loops are already amplifying, accelerating, and synchronizing global systemic risks: 1. The COVID pandemic has been causing economic dislocations, which causes economic inequality, which in turn causes conflicts, and 2. Extreme weather events have led not just to physical damage, but also to food shortages and high inflation rates.

Demography can be integrated into this narrative with this additional bullet:

- A third causal process accelerating, amplifying, and synchronizing global systemic risks is the ageing of populations in the developed world. The resulting shrinking of workforces is a new source of potential supply constraints, inflationary pressures, and elevated nominal and real interest rates.

All this leads to the next logical question: what does all this mean for prospective investment returns through the 2020s and beyond?

Prospective Investment Returns through the 2020s

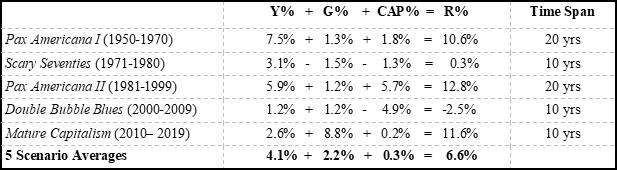

To address this question, we start with Table 1 from the November 2022 Letter. It sets out the real return experience for the S&P500 in the five completed post-WWII ‘narratives’ as we have defined them. Using the Gordon Return Model, total returns are decomposed into three parts: 1. Starting dividend yield (Y%), 2. Real dividend growth over the period (G%), and 3. Change in the dividend capitalization rate over the period (CAP%).

Table 1 The Drivers of Real S&P500 Returns in Five Post-WWII Periods

Table 1 confirms equity returns have varied materially over the 70+yr post-WWII period. Of special note are the dramatic decline in Y% over the entire period, the exceptional earnings/dividend growth experience in the post-GFC Mature Capitalism period, and the declines in CAP% in the two disappointing return periods Scary Seventies and Double Bubble Blues.

Looking ahead from here, we know Y% today is 1.7%. What about G% and CAP%? Bluntly, our Interconnected Instability Era commentary above does not suggest high values for these two return components in the decade ahead. Over the two historical periods when S&P500 returns were poor, G% was effectively 0% and CAP% -3%. Combining this experience with today’s Y% of 1.7%, suggests a marginally negative long term real return outlook for the S&P500 at today’s prices. With long TIPS yielding 1.2% today, equity investments become attractive only when they have a realistic prospect of generating a 5% real rate of return. Undoubtedly, there are still many such 5% real return investment opportunities out there today. However, as the November 2022 Letter noted, this arithmetic suggests it is going require diligent research to identify and invest in them.ii

Bettering the Interconnected Instability Narrative

Fortunately, the future is not written in stone. Recall that authors Goodhart and Pradham discussed two strategies to mitigate the impacts of the negative demographic picture they set out in their book: 1. Extend working lives, and 2. Accelerate productive capital formation by raising the volume and positive impact of retirement savings. Logically, this second strategy will not only help address the increasingly negative demographic deficit we face, but also extends into addressing the increasingly visible energy security and decarbonization challenges that also lie ahead of us.

Indeed, KPA Advisory Services is currently engaged in a project designed to facilitate and strengthen efforts to mitigate the potential negative impacts of ageing in the globe’s developed economies.

On February 6, 250 people will gather at the University of Toronto’s Rotman School of Management (with many more hundreds connected virtually) to watch Theo Kocken’s film YOUR HUNDRED YEAR LIFE. Readers of this publication will recall that the September 2022 Letter reviewed the film and suggested its three key messages wereiii:

- Demography is Destiny: with the original observation attributed sociologist August Comte (1798-1857), this is not a new idea. What may be new is the accelerating power of the idea, with increasing life expectancies growing the older end of the age distributions in the developed world, while falling fertility rates are shrinking the younger end of those distributions. How the combined impact of these two realities is skewing population age distributions upwards has not been built into the design of our health care, working career, habitation, and retirement income systems.

- Rethink and redefine the Human Life-Cycle: retire the traditional prework/work/post-work life-cycle model and redefine the roles people can take on as they evolve from young….to middle-aged….to older people. Taking this step triggers valuable new ideas and actions people can take over the course of their life-journeys. On the work front, this includes the possibility of people transitioning from full time work in their 60s to a redefined ‘legacy’ work journey in their 70s and even 80s. On the habitation front, it means forming communities of people in their 60s, 70s, 80s and beyond that continue to live independently, but with shared health care services and socialization opportunities.

- Behavioural Economics Matters: specifically, its research findings indicate that through well-constructed defaults, people can be nudged to do beneficial things (e.g., save for retirement) without having to think deeply about them, and without having to proactively make difficult decisions to achieve those beneficial ends. At the same time, the investment and benefit administration services required to generate adequate lifetime income at a reasonable cost should of ‘best practice’ quality, acting solely in the best interests of plan participants.iv

The agenda for the February 6 event is to screen the 1-hour film, and then to have a 4-person expert panel delve more deeply into the practical challenges of actually addressing the health, habitation, work, and finance dimensions of the film’s messages. Go to Endnote v below if you would like to join this event virtually.v

In Conclusion

The prime purpose of this Letter is to integrate the demography dimension into the Interconnected Instability Era narrative. A second purpose is to remind readers that they and their organizations can choose not to be passive bystanders as this Era unfolds. Much can be done to soften the negative impacts of ageing on a warming planet, and much can be done to identify competitive investment opportunities for the 2020s and beyond.vi

Keith Ambachtsheer

Endnotes:

- Homer-Dixon, Renn, Rockstrom, Donges, and Janzwood, “A Call for an International Research Program on the Risk of a Global Polycrisis”, July 2022.

- Japan provides a dramatic historical example of a stock market that got ahead of itself. It traded at 40,000 in 1990. Today, some 30+ years later, it is trading in the 28,000 area.

- Dr. Theo Kocken is Professor, Pension and Risk Management, VU University, Amsterdam, and NWU University, South Africa. He is the Founder of the Anglo-Dutch firm Cardano Risk Management, and is Chair of Cardano Development Foundation. He has authored multiple books and articles on pensions and financial markets, and has recently expanded into the documentary film medium.

- See, for example, the December 2022 Letter for more on this topic. It argues stronger corporate governance functions are needed to deal effectively with the challenges of the Interconnected Instability Era. Pension funds and other long-horizon investors are in best positions to bring this upgrading about. However, that in turn requires that these investors have strong governance functions themselves.

- The event starts at 3:30pm EST and finishes at 6pm. Click HERE for information on how you can register.

- For example, the November 2022 Letter discussed using Madden’s 4-stage corporate lifecycle model and Goodfellow/Willis’ 4 corporate pathways to net-zero emissions framework to help identify these opportunities. It also suggested that pension funds and other investment organizations need to strengthen their internal expertise in such areas as business governance and management, legal, science, and engineering.

KPA Advisory Services is pleased to share this edition of The Ambachtsheer Letter with all readers; if you wish to become a KPA Advisory Client/gain access to ALL Letters, please see the Services page on our website.

The information herein has been obtained from sources which we believe to be reliable, but do not guarantee its accuracy or completeness.

Advisory Service clients have access to full issues of the Ambachtsheer Letter.

Become an Advisory Service Clientor Login