Introducing The Interconnected Instability Era: A New Context For Decision-Making In Pension Organizations

“’Business as usual’ could result in a breakdown of global order into a world of perpetual crisis and ‘winner-takes-all’ behavior.”

Antonio GuterresUN Secretary GeneralJuly 2022

“We find ourselves at a tipping point in the sustainability revolution.”

Al GoreFormer USA Vice PresidentCo-Founder, Generation Investment ManagementSeptember 2022

“This year, capital markets further evolved how they integrate environmental impact, societal pressure, and governance risk into day-to-day drivers of performance. We believe these actions reflect the reality that anticipating and managing these risks and opportunities will determine the decade-to-decade staying power of companies.”

2022 Report on Sustainable InvestingCPP Investments

'Context’ Matters

Organizations have always needed ‘context’ for making strategic business decisions. Thus this publication has been setting out socio-economic context narratives for pension organization decision-makers since its inception in 1985. Most recently, this is how the September 2021 Letter put it:

“Starting after WWII, the stable high-growth Pax Americana I’ (1950-1970) evolved into the stagflation ‘Scary Seventies’ (1971-1980), into another stable high growth ‘Pax Americana II’ (1981-1999), into the boom-bust ‘Double Bubble Blues’ (2000-2009), and then into the current ‘Mature Capitalism’ era (2010-?). This current decision-making context has been characterized by aging demographics, steady but slowing GDP growth, low inflation, low interest rates, globalization, strong corporate profit growth, and rising asset prices in the public and private corporate equities, real assets, fixed income sectors. As a result, retirement savings pools are at all-time highs, but so are the reserves needed for workers and retirees to maintain their living standards in the years ahead. The legal standing of these reserves in Pillar 2 pension plans has been changing, moving away from backing sponsor-issued guarantees towards supporting collective risk-pooling arrangements, or worse, towards millions of individual retirement savings pools with no risk-pooling options at all.”

This Letter asserts that the time has come to turn the page on the largely benign Mature Capitalism decade that followed the rocky 2000-2009 Double Bubble Blues decade. The time has come to consider a future that will likely look, feel, and be materially different from the ‘no worries’ Mature Capitalism decade which now lies behind us.

Turning the Page

Plausibly, with the advent of, and the still-lingering health and economic consequences of the COVID pandemic, with the increasingly visible physical ravages caused by climate change, and with the rising levels of social discord both among countries and within them, we have entered new regime that can be reasonably characterized as the Interconnected Instability era.

What key attributes will distinguish this new era from its five post-WWII predecessors? And what are the plan design, governance, and investment strategy implications of these attributes for pension organizations? Those are the challenging questions this Letter addresses. We start by understanding more clearly where we have come from.

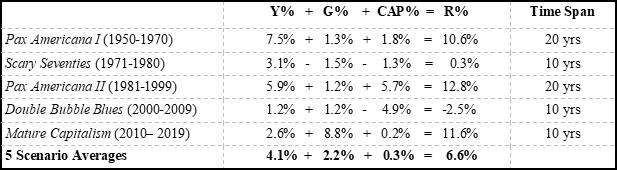

Table 1 below sets out quantitative imprints of real equity returns in the five post-WWII eras as captured by the S&P500 index. The total real return decomposition structure is based on the Gordon Model, which divides total investment return for any investment period into three components:

R% = Y% +/- G% +/- CAP%

Y% is the starting income yield, G% is income growth over the investment period, and CAP% is the return impact of a valuation change due to a change in the rate at which future income is discounted. If R% is expressed in real (i.e., net of inflation) terms, then G% and CAP% must also be expressed in real terms. The resulting 3-component investment return structure provides important insights into the behavior of investment returns. Fixed income investments have only the Y% and CAP% components. Equity investments have the additional G% component, recognizing the important ability of businesses to grow their cashflows over time, but also recognizing that G% is not necessarily always a positive number.

Table 1 The Drivers of Real S&P500 Returns in Five Post-WWII Periods

Table 1 offers important insights from the 70yr post-WWII period:

- Y% was 7.5% at the start of the Pax Americana I period, reflecting investors requiring a high equity risk premium in the early 1950s. Y% declined materially over the subsequent 70 years, to under 2% in recent decades. This is in line with similar declines in long-term bond yields, especially since the start of the Pax Americana II period, when bond yields were well into the double digits after the Scary Seventies. Note that CAP% was the major contributor to the outsized real equity R% of 12.8%/yr. over the Pax Americana II period.

- The Scary Seventies and Double Bubble Blues decades bucked that downward Y% trend, as both bond yields and required equity risk premiums rose. This produced negative CAP% outcomes in those two decades.

- G% generally grew in line with GDP growth in the first four post-WWII eras, and then became the major real equity R% driver in the Mature Capitalism decade. This was partially due to the corporate profits generally increasing their share of national income, and partially due to the increasing index dominance of the low Y%, but high G% FAANG companies using new technologies to attract and retain customers.i

The Interconnected Instability Era

Seldom has a new era so visibly and forcefully introduced itself. First there was the onslaught of the COVID pandemic starting in March 2020 and still with us today, then came the January 2021 Capitol Hill assault in Washington DC, and more recently the military assault on the Ukraine by Russia starting in February 2022. Neither of these assaults is close to a peaceful resolution today. Meanwhile, through the entire 30-month period over which these destabilizing socio-military events took place, the world has been inundated by deadly fires, floods, and storms in some places, and by crop-killing droughts in others.

How can we make sense out of this cascading series of catastrophic events over the course of the last 30 months? A research program being jointly proposed by members the Cascade Institute, the Institute for Advanced Sustainability Studies, and the Institute for Climate Impact Research proposes to address this question:

- Humanity is facing an array of grave, long-term challenges, now often labelled ‘global systemic risks’. While we know a lot about the individual causes of these crises, our understanding of the causal links between them remains shallow.

- What causal processes might be accelerating, amplifying, and synchronizing these risks within global natural and social systems? Two obvious candidates are 1. The growth in scale of humanity’s resource consumption and pollution output, and 2. The vastly greater connectivity between human systems permitting higher volume and velocity of long-distance flows of goods and information.

- Addressing the ‘causal processes’ question could lead to the concept of a ‘global polycrisis’: a single macro crisis of interconnected, runaway failures of Earth’s vital natural and social systems that irreversibly degrades humanity’s prospects.

- Global scientific collaboration to discern the causal mechanisms of a ‘polycrisis’ could lead to actionable policies to mitigate such a disastrous outcome.

Their 10-page proposal elaborates on these ideas. Illustrations of how feedback loops might already be amplifying, accelerating, and synchronizing global systemic risks are especially helpful. Examples relate to the pandemic causing economic dislocations, to economic inequality causing conflicts, to extreme weather events causing not only much physical damage, but also food shortages and high inflation rates.ii

Investment Return Implications

This framing of investment ‘context’ for the 2020s and possibly the decades that follow looks a lot more like some combination of the Scary Seventies and Double Bubble Blues eras than like some combination of the three more positive ones. The average realized real S&P500 returns and their components in those two challenging periods work out to:

R% = 2.2% + 1.4% - 3.1% = 0.5%

With long inflation-linked Treasury bonds (TIPS) yielding 1.4%, a 0.5% S&P500 real return expectation implies the index is not an acceptable investment option today. Using a rule-of-thumb equity risk premium of 4%, the S&P500 becomes an acceptable investment option with an expected real return of 5.4% (i.e., 1.4%+4.0%=5.4%). Stated differently, given the S&P500’s current dividend yield of 1.7%, expected long-term real dividend growth from here (i.e., G%) would have to be 3.7% to achieve the target 5.4% real return (i.e., 1.7%+3.7%=5.4%). While a G% of 3.7% is well below the realized Mature Capitalism G% of 8.9%, it is well above the average G% of 1.3% realized in the prior four investment ‘contexts’. Stated still differently, investors will have to make a strong case for continued strong earnings and dividend (or share buy-back) growth for S&P500 stocks to justify investing in the index at its current level.

Investment Strategy Implications

Of course, investing in broad equity indexes is not the only possible strategy with the prospect of earning an acceptable equity risk premium. Indeed, we set out a radically different approach in the June 2022 Letter titled “Rethinking Pension Fund Investment Strategy: Why and How”. It noted our steady movement away from traditional portfolio optimization and efficient capital markets theories, and towards understanding the emerging socio-economics and investment implications of the decade ahead. This means integrating Kay/King’s radical uncertainty frameworkiii, Madden’s corporate lifecycle frameworkiv, and Goodfellow/Willis’s net-zero corporate pathways framework.v This integration process leads to a focus on visualizing the ‘deep’ risks and opportunities that lie ahead, and the resulting investment strategy choices facing pension and other long-horizon investment organizations.vi

These prospective risks and opportunities don’t just show up in Inboxes. Identifying them requires business and investment expertise diverse in function (e.g., governance, c-suite, IT/AI), in technical knowledge (e.g., legal, scientific), and in geography (e.g., Asia, Europe, Middle East, Latin America). This kind of expertise differs materially from the ‘quant’ expertise needed for traditional asset management. Organizationally, it also requires a culture of mutual accommodation, collaboration, and well-designed incentive structures. It is no small task to create, foster, and sustain an investment organization with these features. And to create, foster, and sustain it is not enough. To gain and maintain the trust of the pension organization’s stakeholders, it must also be clearly communicated to them.vii

Welcome to the new world of Interconnected Instability!

Keith Ambachtsheer

Endnotes:

- FAANG=Facebook/META, Apple, Amazon, Netflix, Google/Alphabet. Maybe it should be FAANGT, thus permitting the addition of Tesla to the lineup.

- Homer-Dixon, Renn, Rockstrom, Donges, and Janzwood, “A Call for an International Research Program on the Risk of a Global Polycrisis”, July 2022.

- See the August 2019 Letter for more on the Kay-King radical uncertainty framework. Its essence can be captured by this quote from the introduction to their book: “Risk in a world of radical uncertainty is the failure of a projected narrative, derived from realistic expectations, to unfold as envisaged.”

- See the October 2021 Letter for more on Madden’s corporate lifecycle framework. Its essence is to assert that just like humans, organizations too have lifecycles. Four Stages to be specific: 1. ‘High Innovation’, 2. ‘Competitive Fade’, 3. ‘Mature’, and 4. ‘Failing Business Model’. Through multiple stories he shows that successful value- creating firms generate returns above their cost of capital by surviving Stage 1 and avoiding Stage 4.

- This framework assesses the ability of a corporation to move to a ‘net-zero’ emissions state from current operations. Pathway 1 companies can get there with their current business models by adopting core eco-efficiencies (e.g., Apple). Pathway 2 companies need to fundamentally transform their business models to move to a ‘net-zero’ emissions state (e.g., fossil fuel producers). Pathway 3 companies are new ones, designed with the ‘net-zero’ constraint in mind. They are potential industry disruptors (e.g., Tesla). Conceptually, it is interesting to integrate the Madden and the Goodfellow/Willis frameworks. Surely some of the Pathway 1 and 2 companies are candidates for Madden’s Failing Business Model category.

- See CPP Investments’ just-released Report on Sustainable Investing for its views on this integration process.

- This clear communications requirement also raises the topic of sustainable pension plan design. The November 2021 Letter “Improving the Globe’s Retirement Income Systems: How Are We Doing...And How Can We Do Better?” recently addressed this challenge.

KPA Advisory Services is pleased to share this edition of The Ambachtsheer Letter with all readers; if you wish to become a KPA Advisory Client/gain access to ALL Letters, please see the Services page on our website.

The information herein has been obtained from sources which we believe to be reliable, but do not guarantee its accuracy or completeness.

Advisory Service clients have access to full issues of the Ambachtsheer Letter.

Become an Advisory Service Clientor Login