Investing In The New Interconnected Instability Era: Only 'Adaptive' Strategies Will Succeed

“The ‘Adaptive Markets Hypothesis’ (AMH) looks at financial markets as a dynamic ecosystem. This allows us to understand the relation between investment performance and the interactions of various types of investors. You may not be able to time the markets day by day, but you can certainly see trends over longer holding periods.”

Prof. Andrew LoMIT Sloan School of Management

The Power of the AMH

Prof. Andrew Lo made an important contribution to investment theory with his 2004 Journal of Portfolio Management article “The Adaptive Markets Hypothesis: Market Efficiency from an Evolutionary Perspective”. In short, he put the static Efficient Markets Hypothesis (EMH) on wheels, characterizing financial markets as a dynamic ecosystem with multiple participants and perspectives that change over time. Profs. John Kay and Mervyn King made a similar argument in their 2020 book “Radical Uncertainty” by pointing to the need for maintaining a “projected narrative based on realistic expectations”. Logically, long-term investors who can capture the essence of such narratives and how they change over time should have a comparative advantage in developing and implementing their investment policies through time.

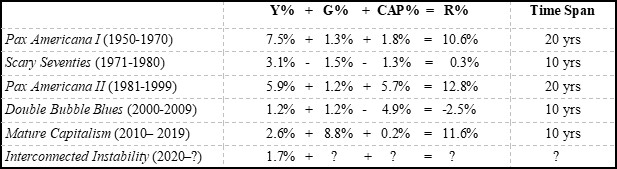

In fact, Lo’s 2004 article and Kay/King’s 2020 book put words to a belief system KPA Advisory Services has been using since its inception in 1985, and most recently updated in our October 2022 Letter titled “Introducing The New Interconnected Instability Era: A New Context For Decision-Making in Pension Organizations”. The essence of KPA’s use of the AMH framework is captured in Table 1.

Table 1 The Drivers of Real S&P500 Returns in Six Post-WWII Periods

Table 1 commentary:

- Financial markets and their participants have been through five distinct socio-economic ‘narratives’ in the last 70 years ranging 10-20yrs in length. A sixth, the prospective Interconnected Instability Era is deemed to have commenced in 2020, and is likely to be dominated by negative investor sentiment in the face of ongoing interconnected environmental and social challenges and disappointments, possibly for multiple decades.

- Using the S&P500 as an equities proxy, three of the five historical periods exhibited strong real equity returns. The two where negative sentiment-dominated (Scary Seventies and Double Bubble Blues), produced zero to modestly negative real returns over 10yr periods.

- Using the adaptation of the Gordon Growth Model to decompose the real S&P500 return over the completed investment periods into income (Y), growth (G), and capitalization change (CAP) components, the CAP component was negative in both of the negative sentiment periods. The G component was also negative in the Scary Seventies.i

- Further, the S&P’s Y today is only 1.7%, well below the 3.1% at the start of the Scary Seventies, and only marginally above the 1.2% at the start of Double Bubble Blues decade.

All this is important context for organizations that must invest retirement savings in the new negative sentiment Interconnected Instability Era. Historically, this kind of investment environment has generated low to even negative real returns in broad equity markets for extended periods of time.

What About Interest Rates and Risk Premiums?

In the spirit of AMH thinking, William Bernstein wrote a 2013 FAJ article titled “The Paradox of Wealth”. It offers important perspective on the path of interest rates and the equity risk premium through history. In his words “both theory and empirical evidence support the notion that persistent long-run economic growth lowers prospective investment returns by reducing 'impatience' for consumption and altering the supply/demand dynamics of capital”. In other words, while persistent wealth creation is accompanied by strong investment returns, it also changes the trade-off between consumption now….and consumption later. And, as the willingness to save and invest increases with rising prosperity, the prospective returns required to direct future savings into capital formation fall. At the same time, as the ratio of physical capital relative to labour rises, prospective marginal returns on that capital also fall.

The broad decline in interest rates and dividend yields in the Post-WWII period is consistent with Bernstein’s thesis. For example, long TIPS yielded 4% in 2000 and that yield went negative a few years ago in the Mature Capitalism era. Today it is back up to 1.4%. Similarly, the S&P500 yielded 7.5% in 1950 and only 1.2% in 2000. Its dividend yield today is back up to 1.7%. These realities add further context for pension organizations investing retirement savings in financial markets today. While recent falling financial asset prices have improved equity and fixed income return prospects somewhat, they are still elevated by historical standards. Thus these prices continue to be vulnerable to the shocks the Interconnected Instability Era is likely to continue to produce. As just one example, the required energy transition out of fossil fuels to renewables and rebuilding a destroyed Ukraine will involve converting $trillions of future savings into physical capital, exerting upward pressure on interest rates and risk premiums.

So What To Do?

Pension organizations do not have the option of sitting out the Interdependent Instability Era. So they must determine what kind of investment policies will best serve their stakeholders in this still new environment. Our Letters have been addressing this challenge for some time now. For example:

- Investment Return Decomposition: Table 1 showed that decomposing retrospective and prospective returns into income (Y), growth (G), and capitalization change (CAP) components offers important insights into the behaviour of financial markets through time. Consider a pension organization with a net real return target of 4% in the decade ahead. Given that the CAP factor will likely be neutral at best, what combination of Y + G maximizes the likelihood of actually achieving 4% net real over the course of the next 10 years? What are the most plausible sources of this Y+G combination? And how is risk diversification best implemented? A key clue to answering these questions is the future trajectory of interest rates. To the degree they continue to rise in the years ahead, dividend yields will follow suit, with further negative implications for CAP changes.

- Investment Opportunity Decomposition: The Madden corporate lifecycle framework discussed in our October 2021 Letter offers a sensible approach to organizing the corporate investment opportunity set. There are four stages: 1. Early Growth/High Innovation, 2. High Performance/ Competitive Fade, 3. Mature/Cash Cow, and 4. Failing Business Model. Successful firms earn returns in excess of their cost of capital by surviving Stage 1 and avoiding Stage 4. Goodfellow/Willis provide an interesting ‘net-zero’ pathway overlay on the Madden lifecycle framework by segmenting corporations into three ‘net-zero’ pathway categories. Pathway 1 companies can get to ‘net-zero’ by adjusting their current business model to include core eco-efficiencies (e.g., Apple). Pathway 2 companies need to fundamentally transform their business models to get to ‘net-zero’ (e.g., fossil fuel producers). Pathway 3 companies are new industry disrupters, designed with ‘net-zero’ in mind (e.g., Tesla).ii

- Investment Structure Reorganization: Last month’s Letter noted that the required transition to investing in the Interconnected Instability Era also has material organizational implications. It will require business and investment expertise diverse in function (e.g., governance, C-suite, IT/AI/ML), in technical knowledge (e.g., legal, scientific, engineering), and in geography (e.g., not just North America, Europe, and Oceana, but Asia, Africa, the Middle East, and Latin America as well). This kind of future-making expertise differs materially from the micro ‘quant’ expertise needed for traditional asset management.iii It also requires a culture of mutual accommodation, collaboration, and well-designed incentive structures. It is no small task to create, foster, and sustain an investment organization with these features. And to create, foster, and sustain such a culture is not enough. To gain and maintain the trust of the pension organization’s stakeholders, it must also be clearly communicated to them.

We conclude this Letter with a closer look at these organizational challenges. Specifically, how are CPP Investments and BNP Paribas Asset Management addressing them?

Addressing Sustainable Investment Challenges at CPP Investments

CPP Investments manages the $500B+ asset pool of the Canada Pension Plan from nine offices around world with a combined staff of 2,000+ people. Its most recent sustainability report makes a number of key points. My summary:

- With cashflow sustainability an imperative in the future we now face, CEO John Graham notes that ESG integration is a new reality for the organization. For example, we will target net zero emissions by 2050 by supporting decarbonization efforts throughout the global economy.

- To do this, we must finance emission reductions, invest in ESG solutions, deploy scalable green technologies, mitigate sustainability-related risks, be active, engaged investors, and report regularly to stakeholders on progress made on these objectives. We will increase our exposure to green-transition assets from $60B today to $130B by 2030.

- Organizationally, we created a new Chief Sustainability Officer (CSO) position in 2021. This position, with a Sustainable Investing Group (currently 20 people), a Sustainable Investing Committee, and a cross-organization Virtual Sustainability Team have the collective task of implementing our sustainability vision. We are also partners in 22 external multi-organization collaborative initiatives to achieve these sustainability ends.

- Our two specific innovations thus far are the Abatement Capacity Assessment Framework and the CPP Investments Investment Insights Institute.

As a closing observation, it is noteworthy that the new CSO position at the Senior Managing Director (SMD) level sits beside 12 other SMD level positions, 8 of which are also investment-related. Further, at the 83 lower Managing Director (MD) level positions, only one is directly related to sustainable investing. This suggests more people power will be needed for CPP Investments to achieve its ambitious sustainability goals.iv

Addressing Sustainable Investment Challenges at BNP Paribas Asset Management

BNP Paribas Asset Management manages a €500B+ asset pool for an international collection of individuals, corporations, insurance companies, pension funds, and other asset owner entities. It also has multiple offices around world with a combined staff of 2,700+ people. Its most recent sustainability report makes a number of key points:

- CEO Sandro Pierri notes that the organization was already on a sustainable investment track when he joined in 2017. Recent events have convinced him there is still much more to do under the banner of being a “Sustainable Investor for a Changing World”. That means supporting sustainability in every way possible, which in turn means challenging outdated business models, as well as engaging policy makers and standard setters in finding better ways. Together, these efforts are moving the organization to its net zero emissions goal by 2050. ESG-qualified assets already exceed €330B, over 60% of total assets under management.

- The report introduces the reader to a number key participants in the organization’s sustainable investing efforts. They speak passionately about their roles in creating its structure and in managing the process. For example, The Sustainability Centre currently employs 27 ESG experts who connect to 170 “ESG Champions” embedded in multiple investment teams covering different segments of the globe’s financial markets. There are also multiple connections to outside sources such as data providers, academia, and investment industry collaborations.

As a closing observation, Sandro Pierri’s comment that “a younger generation of investors and savers is demanding a greater focus on investing sustainably" struck a chord. That sentiment came through forcefully in the report.v

Only ‘Adaptive’ Strategies Will Succeed

This Letter asserted that only ‘adaptive’ investment strategies will succeed in an interdependent instability world. It also showed that this involves rethinking where investment returns come from, rethinking how to define and assess the investment opportunity set, and recognizing that this requires a major revamping of the asset management function.

Keith Ambachtsheer

Endnotes:

- Integrating the three return components together: Total R=Y%+G%+CAP% ....where G% and CAP% can be positive or negative numbers.

- John Montgomery and Mark van Clief deserve credit for integrating much of the work going on in this space. Look for their forthcoming book “NET ZERO BUSINESS MODELS: Winning in the Net Zero Global Economy”, Wiley, February 2023. It includes the Goodfellow/Willis pathways framework. Go to www.futurezero.com for more information.

- A forthcoming book by Bril, Kell, and Rasch titled “Sustainability, Technology, and Finance: Rethinking How Markets Integrate ESG”, Taylor&Francis, December 2022, digs deeply into these issues.

- Or alternatively, providing more information on how the expertise of the Sustainable Investment Group is integrated into the organization’s investment decisions would be useful.

- Full disclosure: my daughter Jane Ambachtsheer is BNP Paribas AM’s Head of Sustainability.

KPA Advisory Services is pleased to share this edition of The Ambachtsheer Letter with all readers; if you wish to become a KPA Advisory Client/gain access to ALL Letters, please see the Services page on our website.

The information herein has been obtained from sources which we believe to be reliable, but do not guarantee its accuracy or completeness.

Advisory Service clients have access to full issues of the Ambachtsheer Letter.

Become an Advisory Service Clientor Login