The New Global Pension Transparency Benchmark: What Is It And Why Should You Know?

“What gets measured gets managed.”

Attributed to Peter Drucker

“The Global Pension Transparency Benchmark (GPTB), a collaboration between Top1000Funds and CEM Benchmarking, is a world-first global benchmark for the transparency of pension disclosure. It ranks 15 countries on public disclosure of 4 key value-generation elements for the 5 largest pension fund organizations in the country.”

Amanda White, TOP1000FundsMike Heale, CEM Benchmarking Inc.

Management Requires Measurement

How sustainable will retirement income systems be in the coming decades? This critical question should be addressed regularly both at macro and micro levels. Recognizing the power of Peter Drucker’s ‘what gets measured gets managed’ aphorism, regularly benchmarking macro and micro pension sustainability will foster steps to improve it.

The November 2020 Letter reviewed the most recent findings of the Mercer CFA Institute Global Pension Index. The MCGPI has for 12 years been benchmarking the quality of retirement income systems at the country (i.e., macro) level based on assessments of the systems’ adequacy, sustainability, and integrity. In its 2020 version, the MCGPI covered 39 countries. Notably, the release of the 2020 version stimulated important pension policy discussions in many of the 39 countries covered. Top1000Funds provided detailed coverage of the MCGPI release last Fall.

What about benchmarking management quality at the individual pension organization level? CEM Benchmarking Inc. has been offering ‘value for money’ benchmarking services to pension organizations since 1992. Today, it has over 400 clients in 25 countries that in turn serve 80 million members and collectively manage some $15 trillion in retirement savings. Evidence suggests that this benchmarking is indeed leading to better outcomes. For example, a recent study titled “The Canadian Pension Model: A Quantitative Portrait” used CEM‘s benchmarking databases to identify the key success drivers of the admired Model to be scale, insourcing (especially private markets investing), and investing in internal R&D capabilities.i

Launching the GPTB

To their credit, Top1000Funds and CEM Benchmarking have now combined to create and launch the Global Pension Transparency Benchmark (GPTB), arguably a micro counterpart to the macro MCGPI. The GPTB ranks 15 countries on public disclosure of 4 key value-generation elements for the 5 largest pension fund organizations in each country. The elements are: 1. Governance and Organization, 2. Performance, 3. Costs, and 4. Responsible Investing.

The benchmark metrics for each of these four elements in the 75 pension organizations (i.e., 5 in each of 15 countries) were based on the public disclosures of what they do, and how they go about doing it. Sources were websites, financial statements, Annual Reports, and other publications. Much of the scoring was based on objective Yes/No criteria, although some factors were assessed more subjectively on a 0/1/2 scale indicating Not Available/Basic/Excellent. The 15 countries evaluated were Australia, Brazil, Canada, Chile, Denmark, Finland, Japan, Mexico, Netherlands, Norway, Switzerland, Sweden, South Africa, United Kingdom, United States.

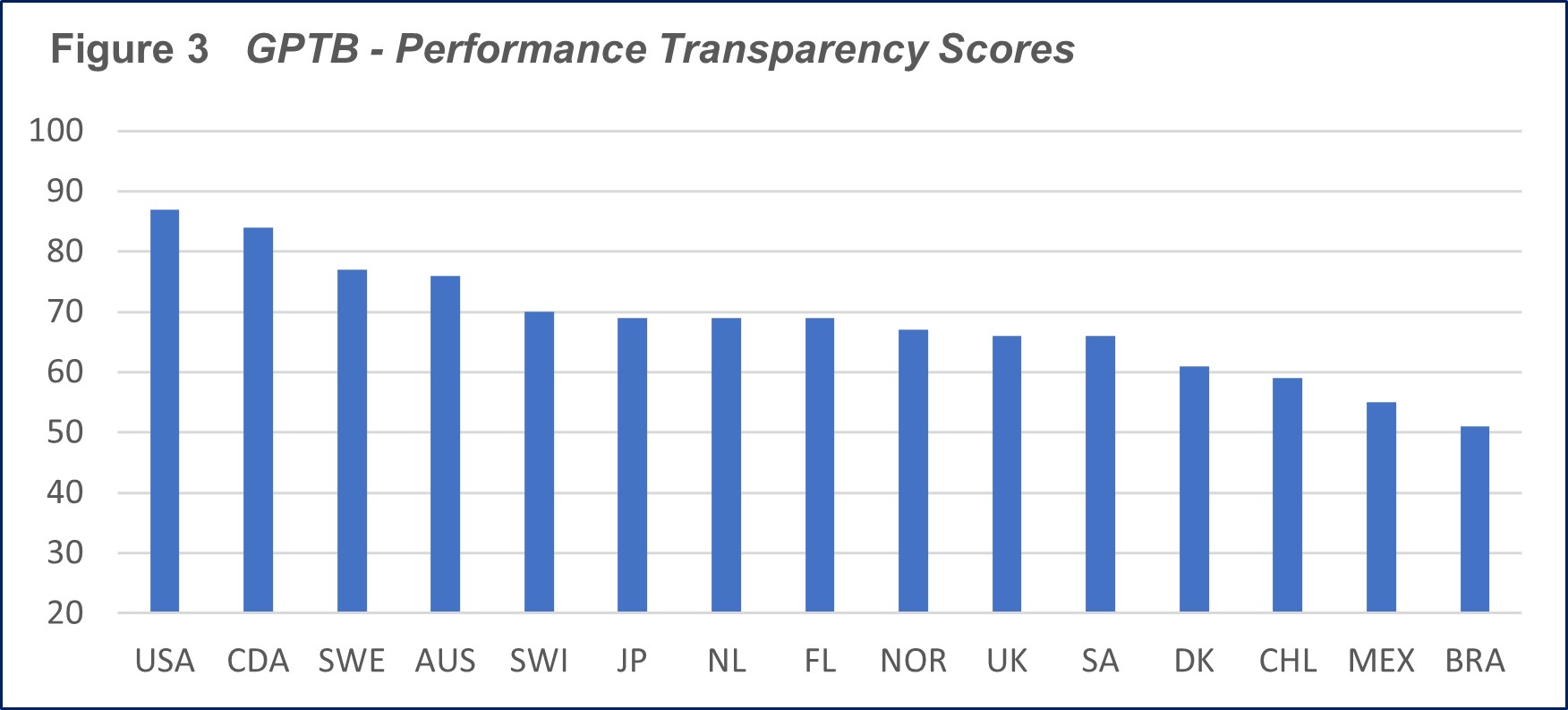

Country GPTB Rankings—Overall

Based on 188 evaluation criteria and 14,100 data points, Figure 1 displays how the 15 countries ranked in the quality of their Overall Pension Transparency disclosures. These overall scores are calculated by averaging across the scores of the disclosure quality of the four value-generation elements (i.e., governance/organization, performance, costs, and responsible investing.) Note that Canada received the Overall Top Score of 74, closely followed by Netherlands, Sweden, and Australia. Countries with the greatest overall improvement potential were Brazil, Japan, Chile, and Mexico.

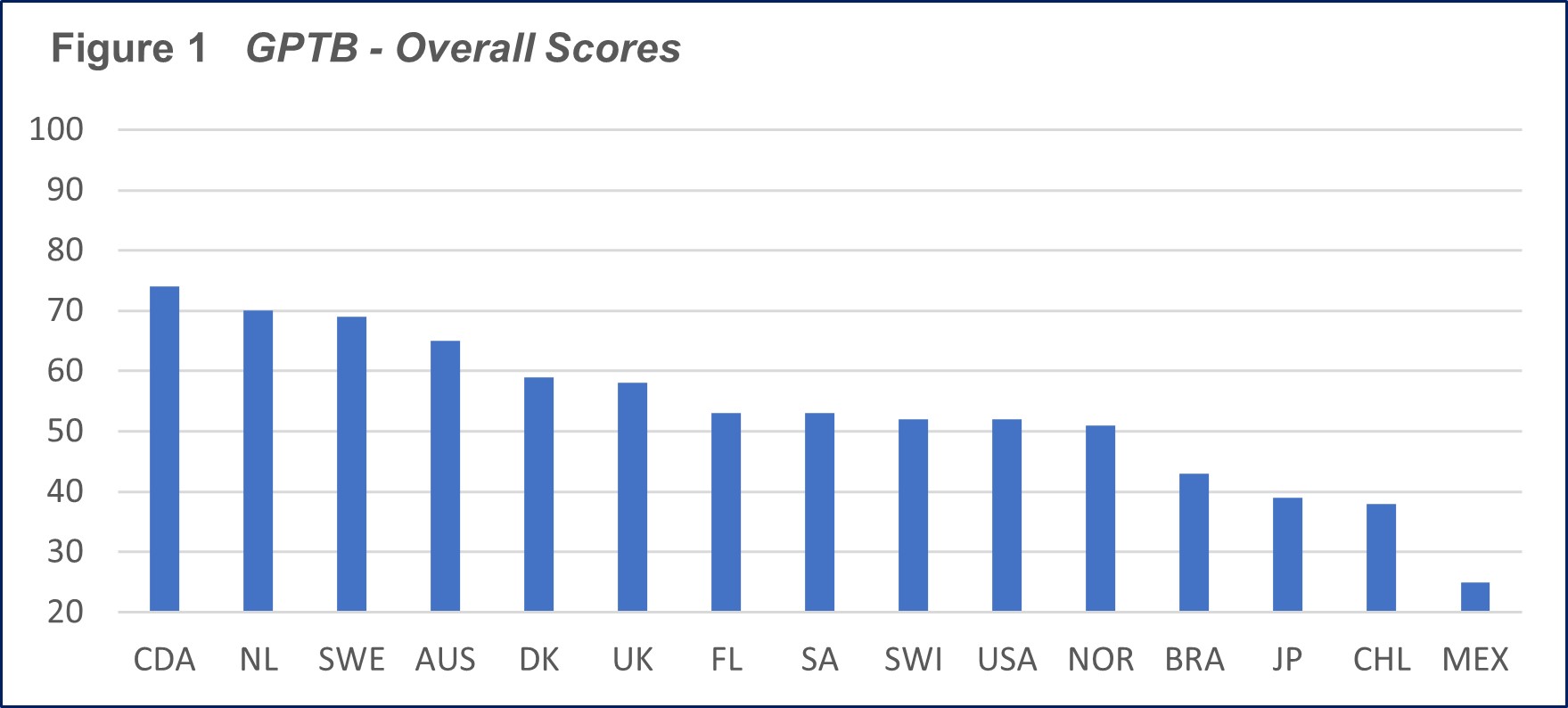

Country GPTB Rankings—Governance and Organization Transparency

Figure 2 displays the results for the Governance and Organization Transparency element. Note that Canada’s #1 score of 86 is materially higher than Australia’s #2 score of 72 with the other 13 scores declining from there. This outcome is consistent with the global reputation for good governance earned by the Canadian Pension Model.

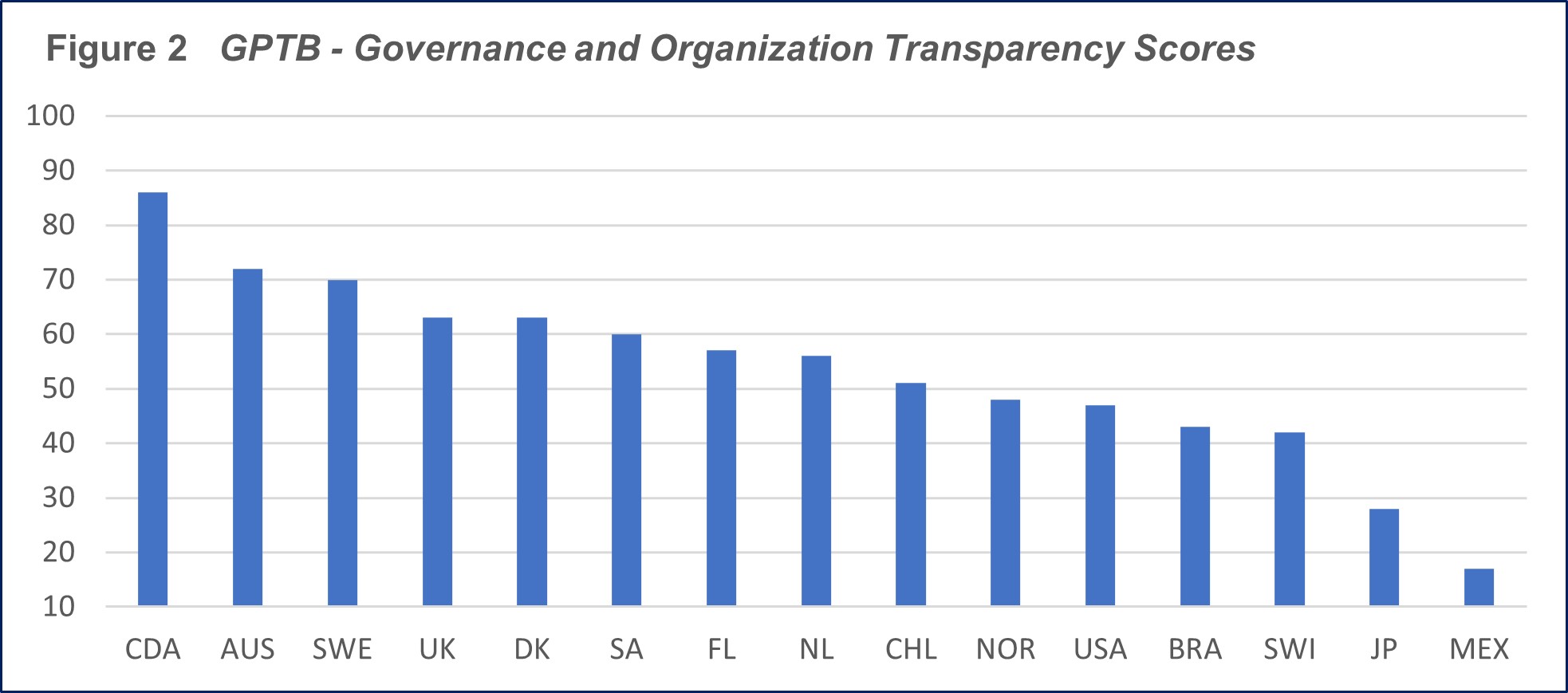

Country GPTB Rankings - Performance Transparency

Figure 3 displays the results for the Performance Transparency element. Note that generally, the transparency scores for performance reporting are materially higher than for the other three elements, with the USA nudging out Canada for top spot.

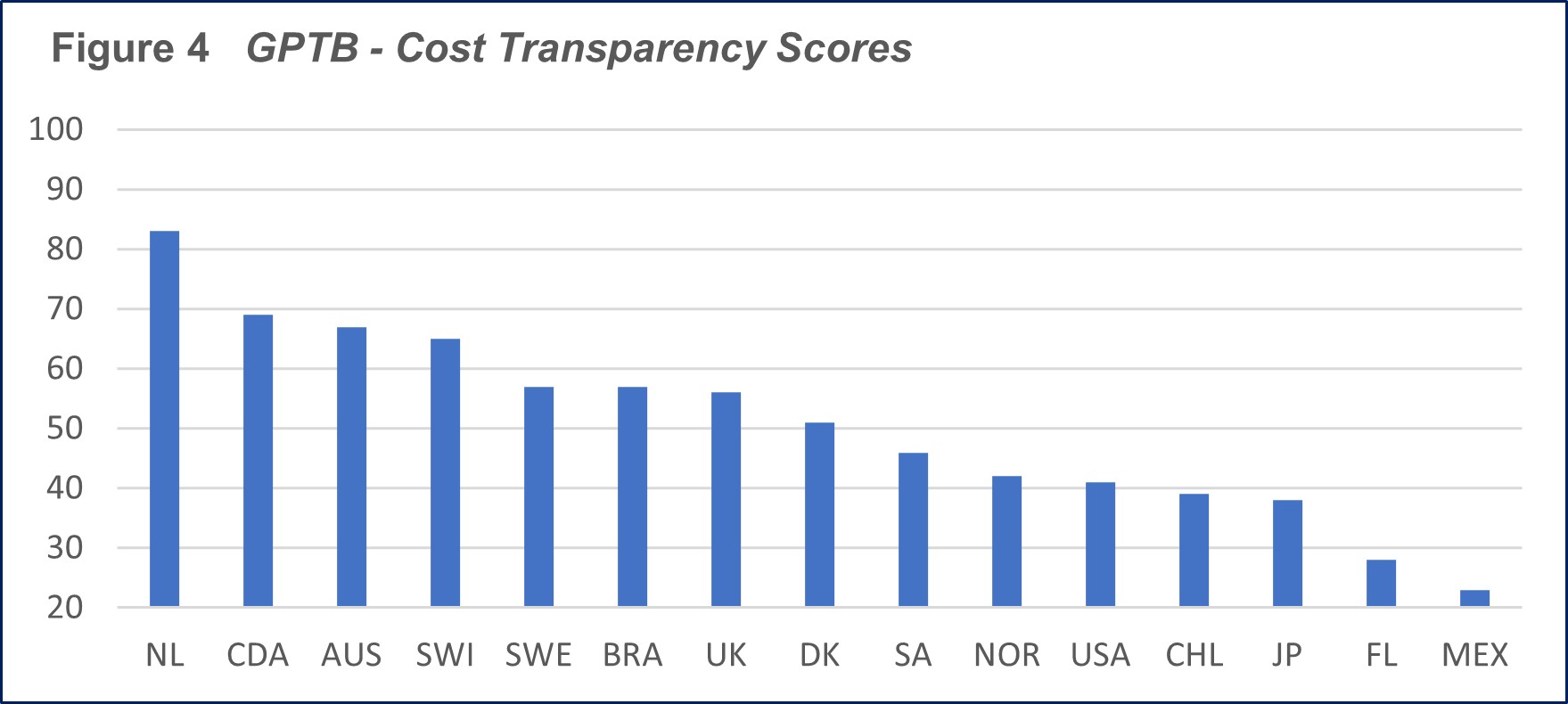

Country GPTB Rankings - Cost Transparency

Figure 4 displays the results for the Cost Transparency element. With its score of 83, Netherlands stands out as doing the best job reporting on the costs of running its pension organizations. There is considerable room for improvement in the countries on the right-hand side of the bar-chart.

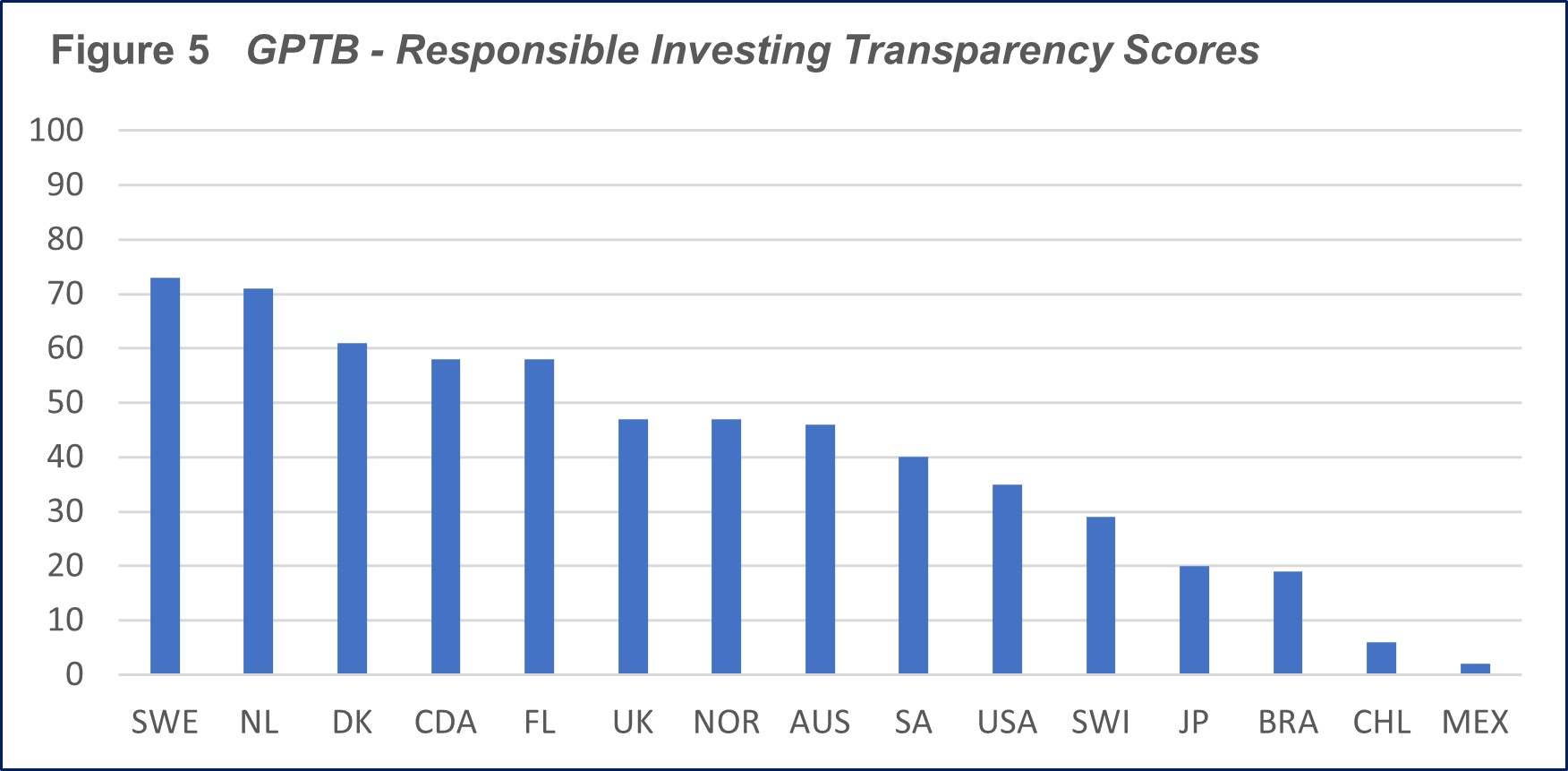

Country GPTB Rankings - Responsible Investing Transparency

Figure 5 displays the results for the Responsible Investing element. As was the case for Cost Transparency, the bar-chart indicates a wide range of transparency scores for the Responsible Investing element with Sweden (73) and Netherlands (71) on the good side, and a number of countries once again with considerable room for improvement.

Where Do We Go from Here?

The GPTB is based on the four noted elements pension funds should be disclosing regularly to their stakeholders: Governance and Organization, Performance, Cost, and Responsible Investing. This raises an obvious question: what is the larger context in which these elements should be placed? Regular readers of this publication know the answer: The Integrated Reporting Framework.

We introduced the Framework to readers some five years ago, and have regularly put it back in the spotlight since then. For example, the April 2019 Letter was titled “Creating Value for Stakeholders and for the Greater Good: How CBUS Super Uses the Framework to Tell its Story”. The good news is that after a slow start, Framework adoption is beginning to accelerate in the corporate world generally, and in the pensions sector particularly. For more on implementation, see my short video. Also, we have launched the Dialogue for Pension Organizations, with a growing number of organizations participating.

The Dialogue has used the Framework to create a template for how the Annual Reports of pension organizations are ideally structured:

Ideal <IR> Report Features

- Strategic/future-oriented, integrative/multidimensional, materiality focus, comparable/complete but also concise (e.g., 40 pages).

Ideal <IR> Report Narrative

- Who are we, what is our purpose, and for who do we create value?

- How are we governed?

- What is our business model and how we use its capitals (e.g., financial, human, intellectual, social) to create value?

- What has our organizational performance been?

- What are the risks and opportunities we and our stakeholders face today?

- What are our aspirations for next year and the longer term, and what are our strategies to achieve them?

Benchmarking Annual Reports

This template can act as a useful benchmark against which to assess the effectiveness of the actual Annual Reports of pension organizations. Two recent benchmarking efforts of actual Annual Reports led to the following Report improvement suggestions:

- Materiality/Conciseness: both Reports were far more than 40 pages. Chair and CEO letters should be shorter. ‘Nice to know’ material should be relegated to appendixes.

- Future-orientation: too much material on the past….too little on the future and strategy.

- Sequencing: did not follow logical order of topics as suggested in the Framework.

- Purpose/Performance: performance metrics should follow logically from organizational purpose. Equal attention should be paid to the performance of financial and non-financial elements.

- Governance: what skill/experience sets does the organization’s Board need to be successful and does it have them?

- Business Model: which capitals are keys to achieving organizational purpose? How are they integrated, deployed, and updated / replenished?

In short, the advent of the GPTB does not signal the beginning of the end of improving pension transparency…..but perhaps the end of the beginning.

Keith Ambachtsheer

Endnotes:

- Full Disclosure: I am co-founder and co-owner of CEM Benchmarking Inc.

KPA Advisory Services is pleased to share this edition of The Ambachtsheer Letter with all readers; if you wish to become a KPA Advisory Client/gain access to ALL Letters, please see the Services page on our website.

The information herein has been obtained from sources which we believe to be reliable, but do not guarantee its accuracy or completeness.

Advisory Service clients have access to full issues of the Ambachtsheer Letter.

Become an Advisory Service Clientor Login