The Accelerating Move To Sustainable Investing: Real Or Imagined?

“Over half of the 75 most influential institutional investors worldwide have a very limited approach to managing ESG risks, receiving either a D or E rating in our benchmarking study.”

Global ESG Benchmarking StudyShareAction, 2020

“There is a large gap between the top and bottom ESG performers among the 50 largest Dutch pension funds. The leading funds have Board-level ESG awareness and expertise. They integrate its implications into the majority of their investment decisions, and into how they measure and report results. The laggard funds lack ESG awareness, expertise, and action. Some recognize this problem, others do not.

Benchmarking Responsible Investing in the NetherlandsVBDO, 2020

“We have seen an acceleration in the last few years in the uptake of ESG investing, as well as a mainstreaming and maturing of responsible investment philosophies and practices. However, there is still much more to be done….”

Strategic Plan 2021/24 Consultation PaperPrinciples for Responsible Investment (PRI), 2020

Are We There Yet?

Media coverage on the growing adoption of sustainable (or RI or ESG) investing practices by investment institutions continues to accelerate. Does this mean that we are close to arriving at the desired full adoption destination? Two new benchmarking studies provide an emphatic ‘no’ to that question (see quotes from the ShareAction and VBDO studies above). We also note that this conclusion is echoed in the preface to the new PRI consultation paper on its proposed Strategic Plan for 2021/24: “there is still much more to be done…..”.

This Letter reviews the methodologies used in the two cited RI/ESG implementation benchmarking studies, as well as their key findings and remedial recommendations. Next, it assesses the key elements of PRI’s Strategic Plan 2021/24 Consultation Paper: how does the PRI organization see RI/ESG implementation unfold over the next four years? The Letter notes that the reviews of these three studies make a strong case for standardizing and implementing a single global RI/ESG implementation benchmarking process. It concludes with our own assessment of the current state of RI/ESG implementation by institutional investors around the world, and the road ahead that must yet be travelled.

Benchmarking RI/ESG Implementation: Process

ShareAction is a UK-based non-profit organization “working for 15 years to build a global investment sector which is responsible for its impacts on people and the planet”. Its 75-fund benchmarking universe is based on the 2018 IPE Global Top400 rankings, with Euro funds capped at 40 and USA funds capped at 20. The RI/ESG Implementation Rankings for these 75 funds were based on a questionnaire with four categories: 1. Responsible Investment Governance (14 questions, 36% of Ranking weight), 2. Climate Change (12 questions, 28% of Ranking weight), 3. Human Rights (8 questions, 19% of Ranking weight), and 4. Biodiversity (7 questions, 16% of Ranking weight). Out of the 75 selected funds, 69 responded to the questionnaire. ShareAction filled in the questionnaire for the six non-respondents based on publicly-available documents.

VBDO is a NL-based non-profit organization that describes itself as “a passionate driver, motivator, and thought-leader on Responsible Investing since 1995”. Its benchmarking universe is the top 50 Dutch pension funds ranked by asset values. The RI/ESG Implementation Rankings for these 50 funds were based on a questionnaire with 50 questions divided into four categories: 1. Governance (16.7% of Ranking weight, 2. Policy (16.7% of Ranking weight), 3. Implementation (50% of Ranking weight), and 4. Accountability (16.7% of Ranking weight). All 50 funds responded to the questionnaire.

Benchmarking RI/ESG Implementation: Rankings

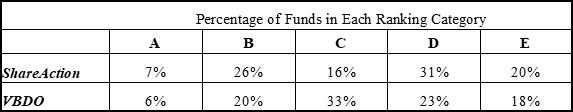

ShareAction reported its 75 RI/ESG Implementation Rankings on an A, B, C, D, E scalei, while VBDO used a 5-0 numeric scale for its 50 Rankings. For comparability purposes, we have (roughly) converted the VBDO numeric scale to the ShareAction alphabetical scale in Table 1. The key message embedded in Table 1 is clear: both the ShareAction and VBDO ranking processes suggest there are as yet only a few ‘A’ players in the RI/ESG implementation world, with a somewhat larger proportion of ‘B’ players on their way up. The majority of survey participants have a long way to go.

Two further observations based on comparing the two sets of Rankings are noteworthy:

- The Dutch pension organizations ABP/APG and PFZW/PGGM are the only Funds ranked in both studies. They rank #4 and #10 respectively in the 75-fund ShareAction study, and #1 and #4 respectively in the 50-fund VBDO study. This suggests the two ranking methodologies, though different, lead to similar conclusions.

- The size of the Funds in the Dutch VBDO study drops quickly after ABP, PFZW, and a few other very large Funds. So not surprisingly, there is a positive correlation between size and RI/ESG Implementation Rank, as smaller Funds generally lack the requisite RI/ESG management resources. In contrast, the 75 Funds in the international ShareAction study are much bigger, and there is no obvious correlation between Fund size and RI/ESG Implementation Rank. For example, giant asset managers Blackrock ($6.4T), Vanguard ($4.9T), and Fidelity ($2.4T) received poor D, E, and E Rankings respectively.

Table 1 Comparing the ShareAction and VBDO RI/ESG Implementation Rankings

Sources: ShareAction, VBDO, KPA Advisory Services

Benchmarking RI/ESG Implementation: Action Recommendations

Not surprisingly, given the similar findings in the two studies, they result in similar RI/ESG implementation action recommendations. Here is an edited summary:

- Ensure there is adequate RI/ESG knowledge and accountability at the Board and Senior Management levels.

- Ensure strong RI/ESG integration both within the organization and with outside service providers.

- Set specific, time-bound RI/ESG goals and targets.

- Develop/strengthen RI/ESG voting policies and voting transparency.

- Identify, manage, and report on the ‘real world’ impacts of the organization’s investment decisions on the E, S, and G dimensions of the UN Sustainable Development Goals.

The recently released 2021/24 Strategic Plan discussion paper by the PRI organization offers a similar view on where it believes its 3500+ signatories must take RI/ESG implementation from here.

PRI’s Strategic Plan – 2021/24

PRI’s broad vision sees responsible investors participating in sustainable financial markets to create a prosperous world for all. Note that this closely mirrors the fifth action recommendation that came out of the two above-cited implementation benchmarking studies. So what must PRI’s 3500+ signatories do bring this vision to life? Here is PRI’s ‘to do’ list for responsible investors:

- Incorporate PRI’s six principles into how its signatories actually invest by creating additional incentives (e.g., strengthen PRI’s minimum standards, celebrate signatory leadership initiatives, provide attractive education opportunities). Apply to both the developed and emerging sectors of the global economy.

- Prioritize outcomes over processes.

- Build greater confidence in reported outcomes by incorporating credible assurance protocols.

- Collaborate with like-minded investors on systemic issues.

There is a separate ‘to do’ list for fostering sustainable financial markets:

- Engage to ensure RI/ESG principles are incorporated into financial policy and regulation.

- Engage with financial market participants to ensure their services are aligned with the sustainability needs of investors.

- Participate in the creation of a global sustainability reporting system for investors and corporations, including comparable data and metrics.

All these PRI efforts are geared to shaping three real world outcomes: creating prosperity, fostering human rights, and respecting finite planetary boundaries.

A Logical Next Step in Benchmarking

Effective benchmarking is a powerful prod to organizational improvement. Being assigned a D or E while others earn an A sets off organizational alarm bells: why are we performing so poorly and what will it take for us to move up the ranking scale to a C, a B, and eventually an A? In this context, the benchmarking initiatives by ShareAction and VBDO are to be commended. They have surely prompted board-level improvement questions about the effective integration of the RI/ESG dimensions into the investment processes of participating organizations. At the same time, a key element of PRI’s strategic plan is to raise minimum standards for the implementation of its six responsible investing principles. This intent opens the window for PRI to establish a more formal, comprehensive, and transparent RI/ESG implementation benchmarking process.

Specifically, why not upgrade PRI's current process through the lessons learned in the ShareAction and VBDO benchmarking initiatives? A single 'best practices' protocol for all would standardize assessment of the actual progress being made towards RI/ESG integration into institutional investment processes around the world. It would also allow PRI to set the new minimum implementation standards it is seeking. For example, it could require all signatories short of an 'A' grade for RI/ESG integration to improve their current grade by at least one level within a specified time period. PRI could also require signatories to provide assurance that the benchmarking information they are providing is factual and verifiable. Finally, opening up a single 'best practices' protocol to regular improvement reviews ensures it stays fresh and keeps up with changing circumstances and research findings.

The Road Ahead for Sustainable Reporting

Efforts to improve reporting protocols and standards in both corporate and asset owner and manager contexts must continue. Four recent examples of progress in that direction:

- The SASB and IIRC organizations recently announced their merger as the Value Reporting Foundation, and their intent to continue working with other reporting organizations towards a single sustainability reporting protocol.

- The IFRS Foundation recently issued a Consultation Paper on Sustainability Reporting proposing the formation of a Sustainability Standards Board (SSB) to operate parallel to the International Accounting Standards Board (IASB).

- Looking beyond these ‘incrementalist’ approaches, the UN Research Institute for Social Development and r3.0 have launched an initiative to develop sustainable development performance indicators related to “real-world thresholds”.

- Closer to the ground, IIRC and KPA Advisory Services have launched the <IR> Dialogue for Pension Organizations, with participating pension funds working together to adapt the <IR> Framework to the specific needs of their organizations.

Similarly, it is important to ensure that in the process of integrating RI/ESG principles into investment processes, the fundamental requirement to generate a competitive rate of return is not lost.

The Road Ahead for Competitive Return Generation

Our September Letter “Future-Proofing Pensions: Integrating the Wisdom of John Maynard Keynes and Peter Drucker” made the important point that there is no role for bonds with negative real yields in the investment policies of going-concern pension plans.ii In their stead, the Letter proposed a portfolio of equities of companies with sustainable revenue streams and divided-paying policies. Unilever was used as an example of such a company…...there are many others.

The fundamental point of that Letter is worth repeating here. The primary goal of the investment policies of pension organizations is to generate high-enough returns to pay adequate pensions at affordable contribution rates. The accelerating move to RI/ESG integration in investing has not negated the primacy of that goal.

Keith Ambachtsheer

Endnotes:

- The actual Ranking scale was a bit more complicated with gradations within the five categories (e.g., within the B category there were BBBs, BBs, and Bs). We simplify here for comparability reasons.

- An important caveat is that there is no foreseeable requirement to sell assets to fund benefit payments.

KPA Advisory Services is pleased to share this edition of The Ambachtsheer Letter with all readers; if you wish to become a KPA Advisory Client/gain access to ALL Letters, please see the Services page on our website.

The information herein has been obtained from sources which we believe to be reliable, but do not guarantee its accuracy or completeness.

Advisory Service clients have access to full issues of the Ambachtsheer Letter.

Become an Advisory Service Clientor Login