Investment Luminaries And Their Insights: The CFA Institute's 'Vertin Award' Recipients Have Their Say

“The work of the Vertin Award recipients over the last 25 years depicts how our industry has changed….and reinforces the importance of remaining intellectually curious…."Margaret FranklinPresident and CEOCFA Institute

“The Vertin Award recipients represent a collection of intellectual leaders in the investment field whose ideas are not only compelling in theory, but also in practice….”Paul AndrewsManaging Director, Research and AdvocacyCFA Institute

“We may not recognize all their names, but everyone in the investment industry owes a debt of gratitude to the recipients of the Vertin Award profiled in this publication….”Bud HaslettExecutive DirectorCFA Institute Research Foundation

Enduring Investment Insights in Theory and Practice

The James R. Vertin Award, established in 1996, is presented periodically by the CFA Institute Research Foundation “to recognize individuals who have produced a body of research notable for its relevance and enduring value to investment professionals”.i To celebrate the Award’s 25th anniversary, the Foundation has published a book titled “Investment Luminaries and their Insights”. It captures the essence of these insights in the Award recipients’ own words. This Letter offers a summary of the key investment insights recognized, and assesses how well they are standing up to the test of time.

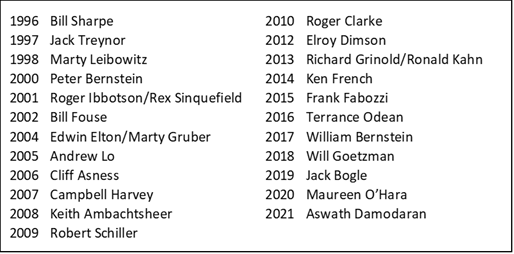

The Award was presented 23 times over the 1996-2021 period, in three cases to a duo of recipients. The table below lists all 26 recipients in chronological order. Many of the names should be familiar to Letter readers…..how many do you recognize?ii

Vertin Award Recipients 1996-2021

Physics or Sociology?

How to assess the relevance and enduring value of the insights on offer in the 23 award-winning bodies of research? Ironically, it is an Economics Nobel Laureate not on the Vertin Award list (but arguably should be) who provides a constructive answer to the question. George Akerlof notes that academic economics and finance now has a strong ‘hard’ (i.e., physics/ quantitative) orientation. Numbers are harder than words….. quantities harder than qualities. Top journals favour 'hard' papers over 'soft' ones, as do evaluators of academic performance. However, Akerlof notes that while the rigour that goes with ‘hard’ is commendable, it may lead to missing ‘soft’ social elements of a problem that are critical to effectively understanding and addressing it. In short, insightful research pays attention to both the ‘hard’ and ‘soft’ sides of a problem.iii

Why is this Akerlof perspective particularly relevant to the Vertin Award story? Because its launch in the mid-1990s came 30 years after the launch of the academic revolution to transform finance and investment from an ‘ad hoc’ to a ‘hard’ field of endeavour. This transformation, which started in the late 1960s, led to Modern Portfolio Theory (MPT), the Efficient Markets Hypothesis (EMH), the Capital Asset Pricing Model (CAPM), and in its more applied forms, stock and bond pricing models, option pricing models, factor models, performance measurement models, low-cost index funds, and the creation of extensive financial markets data bases needed to conduct research in the emerging ‘hard’ world of finance and investing.

Given these developments, it is not surprising that many of the Vertin Award recipients were, and continue to be, key academic and professional leaders in this ‘hard’ modernization of finance and investment theory and practices. Two deserve special note. Through their respective positions as the editors of the Financial Analyst Journal (FAJ) and the Journal of Portfolio Management (JPM), Jack Treynor and Peter Bernstein played critical roles in fostering this multi-decade transition from ‘ad hoc’ to ‘hard’ approaches to both the theory and practice of finance and investing.

Less Physics, More Sociology?

This transition raises an important question: are we now overdoing the ‘hard’ side of finance and investing at the expense of softer, but no less important issues such as human behavior, changing demographics, changing political/economic structures, the changing makeup of financial markets participants, and the processes through which they make investment decisions? To their credit, the Vertin Award decisionmakers have been addressing this question in their selection process. Here are 5 examples:

- Andrew Lo is the creator of the Adaptive Markets Hypothesis (AMH), which is based on the ‘real world’ assumptions that human behavior is biology-driven rather than always rational, that people make decisions based on heuristics rather than optimization protocols, and that the world is a dynamic rather than a static place. The AMH requires adaptive strategies that reflect a continuously changing world.

- Robert Shiller asserts the EMH is a ‘half-truth’ and that a good understanding of behavioral finance (e.g., ‘irrational exuberance’, ‘animal spirits’) is essential to understand financial pricing in the ‘real world’. As a frequent co-author with George Akerlof, he noted the ‘asymmetric information’ problem in their book ‘Phishing for Phools”. Knowing less than the person on the other side of the transaction is usually expensive.

- Terrance Odean is a behavioral finance specialist with a focus on financial market stability. He shows that only markets with heterogeneity (i.e., differing participants with differing trading motives) are stable. He notes that the portfolio insurance failure in 1987 and the LTCM failure 10 years later both offer good examples of what can happen without the presence of that heterogeneity. Ironically, high-powered academics played roles in both market failures.

- William Bernstein points to the strong inverse relationship between societal wealth/wellbeing and investment returns through the centuries. Centuries ago, investors required very high returns to forego current consumption. This is not the case today. Relatively speaking, the supply of investible capital has increased materially, while the demand for it has decreased materially. The result is high capital prices and low prospective returns today by historical standards.

- Aswath Damodaran is a valuation specialist who asserts that while the market price P of an investment and its value V must be the same in the EMH world, that is not necessarily the case in the real world. Here P is determined by market mood, momentum, stories, and liquidity, while V is determined by current and expected future cashflows, as well as the risk attached to them. The latter can vary greatly depending on the business model and the maturity of the investment. The key investor questions are: how good are your V predictions and how can you best use them?

As this is my Letter, I close with a speculation on why I ended up being Vertin Award recipient.

Ambachtsheer’s Vertin Award Insights

As a new hire in the Sun Life investment department in 1969, my first job was 3-fold: 1. Understand what modern Portfolio Theory was all about, 2. Understand how a 'real world' institutional investment department operated, and 3. Assess if applying MPT could improve investment department performance. After a couple of years on the job, I achieved my 3 goals: I understood MPT, I understood how a ‘real world’ investment department operates, and I discovered ways in which MPT could improve investment department performance.

After another year of implementing the improvements at Sun Life, it was time to move on. Institutional broker Canavest House offered me a job to take what I had learned at Sun Life into the larger world. That larger world included a number of large US investment institutions, as well as Vertin Award recipients Bill Sharpe, Jack Treynor, Peter Bernstein, and Bill Fouse. The research findings that came out of this mid-to-late 1970s period were duly reported in a number of JPM and FAJ articles. The bottom line? The proper application of MPT principles can indeed improve portfolio performance.

These JPM and FAJ articles marked my exit out of the ‘hard’ space of applied portfolio theory into the broader and ‘softer’ space of the design and management of retirement income systems. Peter Drucker’s 1976 book “The Unseen Revolution” provided the inspiration. He argued that workers would become the owners of the means of production not through Karl Marx’s violent revolution, but through their pension plans. Who would manage these pension plans? Drucker visualized high-quality, arms-length pension organizations governed under fiduciary umbrellas requiring them to generate pension wealth in the sole best interest of plan participants.

What about the investment beliefs of these Drucker pension organizations? Should they simply accept the EMH and manage their retirement savings pools passively? Or should they rethink the meaning of ‘active management'? The great economist John Maynard Keynes provided the answer. His writings persuaded me that there was much more to investment beliefs than either the ‘hard’ ones embedded in the EMH, or the ‘ad hoc’ ones that drove most professional active management prior to the MPT revolution. Keynes’ three key investment insights were: that 1. Investment professionals seem to be continuously engaged in zero-sum ‘beauty contests’, trying to outwit eachother in predicting which stocks investors will find most attractive a few quarters hence, 2. Real investing is based on understanding how well (or poorly) businesses allocate capital to be sustainably profitable over the long-term, and 3. Most investment committees seem to prefer being ‘beauty contest’ conformists…. “preferring to fail conventionally to succeeding unconventionally”. Unconstrained by such an investment committee, Keynes himself generated an astounding 8%/yr. ‘alpha’ over the 25yr period that he managed the Cambridge University endowment fund.

KPA Advisory Services was created to foster the implementation of the visions/beliefs of my two intellectual heroes Peter Drucker and John Maynard Keynes.

The Birth of the Canadian Pension Model

In the late 1980s the Canadian Province of Ontario assembled a taskforce to improve the functioning of its public sector pension plans. The taskforce recommended the Drucker pension organization model with its strong governance function that would be able to create and oversee a value-adding investment organization.iv Robert Nixon, Treasurer of the Province of Ontario and Margaret Wilson, President of the Ontario Teachers’ Federation bought into the recommendation, leading to the creation of the Ontario Teachers’ Pension Plan (OTPP) in 1990.

A strong, diverse professional board of directors was assembled, who hired the entrepreneurial Claude Lamoureux as CEO, who in turn hired the equally-entrepreneurial Bob Bertram as CIO. Together, they attracted a team of talented investment and pension administration professionals. OTPP started life with a $20B portfolio of non-marketable Ontario bonds. Today it is fully funded, largely internally-managed, with a $220B portfolio diversified across multiple asset classes in the public and private markets of 50 countries employing a Keynesian view of long-term investing. Benchmarked against international peer groups, OTPP’s investment and benefit administration performance metrics are among the highest in the world.

These developments did not go unnoticed. At first, other Canadian funds started to emulate OTPP. Then slowly, major funds outside Canada also began to take notice. A 2012 article on these developments in The Economist publication titled “Maple Revolutionaries” received widespread attention. The article noted “these Canadian funds have won the attention of both Wall Street, which considers them rivals, and of institutional investors, which aspire to be like them”. Peter Drucker’s 1976 “Unseen Revolution” was unseen no longer.v

Insights Gained from my 50-Year Journey

Three come to mind:

- Active management can indeed add value, but not through still-popular ‘beauty contest’ trading strategies John Maynard Keynes called out way back in 1936.

- Instead, it requires building and sustaining arms-length fiduciary organizations that have the motivation, the governance capability, the investment skills, and the scale to be effective.

- Such organizations do not appear out of thin air. Logic suggests and history confirms it takes active leadership to build and sustain them.

Let’s make the Canadian Pension Model the Global Pension Model!

Keith Ambachtsheer

Endnotes:

- I got to know Jim Vertin back in the 1970s. As a Senior Vice President at Wells Fargo, he built an investment team that would pioneer the creation and management of index funds, as well as the use of computer-driven active management strategies employing the dividend discount model. He was a strong believer in investment research and education and a strong supporter of the CFA Institute.

- It is hard to miss the fact that the Award recipient list is highly US/Male dominant. Hopefully that will change over the course of the next 25 years.

- From a 2019 FT article by Tim Harford titled “How Economics Can Raise Its Game”. Akerlof’s major contribution to economic theory in general, and to investment management in particular is the concept of ‘asymmetric information’, which allows knowledgeable sellers of investment management services to charge too-high fees relative to the value of the services provided.

- I was an advisor to the Rowan TaskForce. Its report “In Whose Interest?” was published in November 1987.

- See Ambachtsheer “The Canadian Pension Model: Past, Present, and Future”, JPM April 2021, for the full story. The article was written at Vertin Award recipient Frank Fabozzi’s invitation.

KPA Advisory Services is pleased to share this edition of The Ambachtsheer Letter with all readers; if you wish to become a KPA Advisory Client/gain access to ALL Letters, please see the Services page on our website.

The information herein has been obtained from sources which we believe to be reliable, but do not guarantee its accuracy or completeness.

Advisory Service clients have access to full issues of the Ambachtsheer Letter.

Become an Advisory Service Clientor Login