Governance In Asset Owner Organizations: Still Room For Improvement

“Organization design does not appear to be on the agendas of many Boards of Directors and CEOs. Since it has been shown to be a driver of organization performance, it deserves a higher profile. CEOs should be accountable for developing, implementing, and maintaining superior organization designs. Boards of Directors should be accountable for ensuring that this happens.”

Claude Lamoureux, Founding CEOOntario Teachers’ Pension Plan

Making an Old Topic New Again

Since its inception in 1985, this publication has periodically featured both the governance topic and the Ontario Teachers’ Pension Plan (OTPP) organization. OTPP’s creation in 1990 came out of a task force recommendation which was in turn inspired by Peter Drucker’s 1976 book on pension design, governance, and investing titled “The Unseen Revolution”.i After 15 years of strong organization performance, OTPP’s founding CEO Claude Lamoureux would echo Drucker’s message on the critical importance of Board governance in fostering strong organizational design and performance (see quote above).ii

This Letter updates both the definition of organizational governance and what we know about its success drivers, focusing especially on the context of asset owner organizations. We start by posing the deductive question ‘what does logic tell us about the key characteristics and accountabilities of effective organizational boards?’ Next, the Letter addresses the question of what is actually going on in the world of asset owner governance, and its impact on the performance of asset owner organizations. It ends by citing five studies which confirm a positive empirical relationship between good governance and good organization performance.

Board Roles and Selection Criteria

Elliott Jaques is often credited with laying the foundation on which to build and implement effective organization designs (e.g., see Jaques (1996) “Requisite Organization: A Total System for Effective Managerial Organization and Managerial Leadership for the 21st Century”). Ron Capelle has further developed and enhanced this framework as outlined in his book “Optimizing Organization Design” (2014). This includes the design and implementation of the Board governance function. I have been fortunate to work with him on asset owner organization design projects.

Capelle posits three broad roles relevant to any organization: 1. An ownership/stakeholder function, 2. A Board governance function to represent owner/stakeholder interests, and 3. A management function that implements Board-approved plans to achieve the goals of the organization. This framing immediately raises an important question: what should be the mechanism for identifying prospective Board members?

Capelle proposes three selection criteria:

- Appropriate skills/knowledge: collectively, the Board needs to have sufficient collective skills and knowledge to exercise its oversight responsibilities. In an asset owner / pension organization context this implies skills/knowledge in investing, risk management, actuarial analysis, audit, HR, IT, strategic management, and stakeholder communications.

- Value the work: so that Board members will fully apply themselves to the tasks at hand.

- Strategic thinking capability: this capability should at least match that required of the CEO, or ideally exceed it. Jaques posits seven Stratum levels for strategic thinking (‘information processing capability’), with Stratum 4 indicating general management capability, and Stratum 5 and up indicating increasing degrees of information processing capability ‘at abstract levels’.

A Board made up of people meeting these three criteria will have the capability to be accountable vis a vis the CEO in five areas:

- Providing appropriate context and prescribed limits: this could relate to owner/stakeholder relations, legal and ethical issues, the identification and management of substantive risk, etc.

- Establishing expected organizational outputs and results: quantities, quality, timelines, business plans, benchmarks, etc.

- Ensuring appropriate resources available to do the work: the right people, physical and financial capital, IT, etc.

- Appropriate delegation of authority: within the set context and limits, the CEO must have the appropriate authority get the work done.

- CEO selection and termination: as well as CEO coaching, feedback, compensation, and performance evaluation.

Finally, Capelle notes that Board members have collective responsibility for CEO issues in these five areas, and have no managerial authority and accountability for employees below the CEO level.

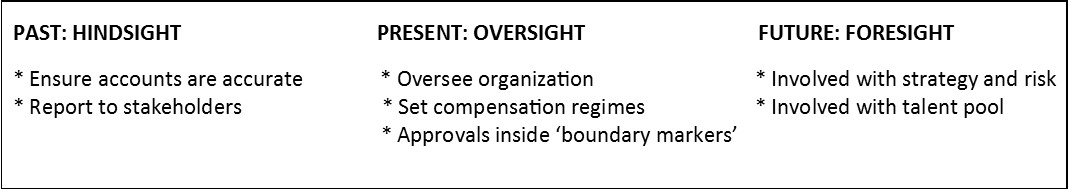

Governance expert David Beatty at the University of Toronto’s Rotman School of Management uses Table 1 below to convey a Board’s responsibilities related to the past, the present, and the future. Note its consistency with Capelle’s framing above.

Table 1 A Board's Three Lines Of Sight

Source: Prof. David Beatty, Rotman School of Management, University of Toronto

Source: Prof. David Beatty, Rotman School of Management, University of Toronto

Asset Owner Governance in the Real World

In relation to this listing of logical ‘shoulds’, what has actually been happening in the real world? KPA was involved in a survey of CEOs of asset owner organizations around the world in 1997, repeated in 2005, and again in 2014. The survey tells an interesting tale. The CEOs were asked to rank 23 governance-related statements in a scale from 5-1. A ranking of 5 meant strong agreement with the statement as it related to his/her organization, a ranking of 1 meant strong disagreement. Rankings of 4, 3, and 2 indicated shadings in between the extremes of 5 and 1. All statements were phrased positively so that 5s were ‘good’ and 1s were ‘bad’. Though almost 10 years apart, the three survey response rates were almost equal (80, 81, 81 responses). Table 2 sets out the five lowest-ranked statements for the three response sets. These five statements should be interpreted as indicating the five areas the CEOs were most uncomfortable with.

Table 2 The Five Lowest-Ranked Governance Statements

| Lowest-Ranked Over 3 Surveys | Mean Score 1997 Rank | Mean Score 2005 Rank | Mean Score 2014 Rank |

| Competitive Compensation | 18 | 18 | 20 |

| Board Self-Evaluation | 20 | 20 | 18 |

| Board Micro-Management | 22 | 21 | 19 |

| Board Selection Process | 21 | 22 | 22 |

| Incentive Compensation | 23 | 23 | 23 |

Source: KPA Advisory Services Ltd.

An important finding in the three surveys was that the same five statements were, on average, ranked lowest in 1997, 2005, and 2014. Note that the poorly-ranked statements relate to Board selection processes, Board performance evaluation processes, and Board micro management (e.g., investment manager selection involvement, compensation issues). This suggests that many asset owner organizations are still falling short in their selection processes for Board members, with likely continuing negative consequences for organizational effectiveness.

New Findings on Board Selection Processes

So what is going on here? Can we find out what is wrong with the board selection processes in many asset owner organizations? Research by Aleksandar Andonov and collaborators have led to the findings set out in Table 3, which indicates what kind of processes are being used to select and appoint Board members to public sector and industry pension plans in USA, Canada, Europe, and the UK. There are three appointment/election sources: 1. State/Government, 2. Participants/Members, and 3. Public selection/appointment bodies. Note that in these categories, Board members can be appointed, ex-officio (automatic board membership due to their political position), or elected.

Table 3 Board Selection/Appointment Processes

| USA | Canada | Europe | UK | |

| State-appointed | 6% | 21% | 32% | 100% |

| State-exofficio | 22% | 0% | 0% | 0% |

| State-elected | 1% | 0% | 2% | 0% |

| Participant-appointed | 13% | 25% | 37% | 0% |

| Participant-exofficio | 1% | 0% | 0% | 0% |

| Participant-elected | 30% | 0% | 2% | 0% |

| Public-appointed | 26% | 55% | 24% | 0% |

| Public-elected | 0% | 0% | 4% | 0% |

Source: Prof. Aleksandar Andonov, University of Amsterdam

The USA is unique in the sense that over half of the pension plan board positions there are either ‘ex-officio’ politicians or participant-elected lay persons. Politicians come with potential conflicts of interest, while lay persons may not have either the skill/experience qualifications or the strategic/abstract information processing capability required to contribute to board effectiveness. In contrast, the appointment processes used in Canada, Europe, and the UK have a better chance of populating boards with people that have these qualifications and capabilities.

Governance Quality and Fund Performance

Does governance quality impact fund performance? Logically, it should….but is there any empirical confirmation? The five studies below suggest a ‘yes’ answer:

- A 1998 study by Ambachtsheer, Capelle, and Scheibelhut: was motivated by a 1992 study titled “Fortune and Folly” which was highly critical of the quality of pension fund governance. Some of the 1998 study findings were already reported in Table 2 (i.e., the 1997 governance quality rankings). The study found positive relationships between fund returns, the subjective governance quality rankings based on fund CEO responses, and an objective organization design quality score as captured by a proprietary Capelle methodology.iii

- A 2017 study by Andonov, Bauer, and Cremers: found a positive relationship between the degrees of political and elected member representation on the boards of US public sector pension plans and their underfunded status.iv

- A 2017 study by Ambachtsheer: based on data from CEM Benchmarking Inc., 7 out of 8 (88%) ‘Canada Model’ funds outperformed their benchmarks versus 80 out of 132 (61%) for the rest. The average outperformance for the ‘Canada Model’ funds was 0.6%/yr. vs. 0.1%/yr. for the latter. ‘Canada Model’ funds use the strategic governance model first adopted by Ontario Teachers’ Pension Plan in 1990. Over the 1990-2018 period, OTPP has generated a 29yr. net annual return of 9.7% vs. 7.7% for its benchmark.v

- A 2018 study by Andonov, Hochberg, and Rauh: found negative relationships between the degrees of political and elected member representation on the boards of US public sector pension funds and their investment returns.vi

- A 2019 study by Merker and Peck: found a positive relationship between the returns of US public sector pension funds and a Fiduciary Effectiveness Quotient (FEQ) constructed and calculated by the authors. The FEQs are based on information contained in multiple years of Board Minutes, extracted on a fund-by-fund basis, focusing on Board composition, engagement, professionalism, knowledge, structure, diligence, and transparency.vii

In conclusion, this Letter offers an overdue reminder that the governance functions in many asset owner organizations continue to offer implementable opportunities for improvement. The good news is that the road to improvement has already been built, and that stronger governance is indeed linked to greater value-creation for stakeholders. Are you and your organization on that improvement road? If not, should you be?viii

Keith Ambachtsheer

Endnotes:

- I was principal advisor to the Rowan Task Force which tabled its Report titled “In Whose Interest?” to the Ontario Government in 1987.

- Lamoureux was OTPP’s CEO from 1990 to 2007.

- “Improving Pension Fund Performance”, Financial Analysts Journal.

- “Pension Fund Asset Allocation and Liability Discount Rates”, The Review of Financial Studies

- “The ‘Canada Model’ for Pension Fund Management: Past, Present, and Future”, The Ambachtsheer Letter

- “Political Representation and Governance: Evidence from the Investment Decisions of Public Pension Funds”, The Journal of Finance

- “The Trustee Governance Guide”, Palgrave Macmillan

- The week-long Rotman-ICPM Pension Governance Education Program helps current and prospective Board members accelerate the governance journey. The next PGEP offering is scheduled to be held in Toronto Nov 30-Dec 4, 2020. Go to https://icpmnetwork.com/site/events/pension-board-education for more information.

KPA Advisory Services is pleased to share this edition of The Ambachtsheer Letter with all readers; if you wish to become a KPA Advisory Client/gain access to ALL Letters, please see the Services page on our website.

The information herein has been obtained from sources which we believe to be reliable, but do not guarantee its accuracy or completeness.

Advisory Service clients have access to full issues of the Ambachtsheer Letter.

Become an Advisory Service Clientor Login