Climate Models Built By Economists: Are They Materially Underestimating Climate Change-Related Risks?

“In the context of climate change, it is as if we are modelling the scenarios of the Titanic hitting an iceberg, but excluding the possibility that the ship could sink. It is deeply concerning that what we see happening in the real world is largely excluded from risk models widely used across the financial sector.”

Prof. Sandy Trust, University of ExeteR

“It is quite possible that the estimates of the economic impact of climate change are not independent, as there are only a relatively small number of studies, based on similar data, by authors who know each other well……this small and close-knit community may be subject to group think, peer pressure, and self-censoring…… “

Prof. Richard Tol, University of Sussex

Two Disturbing New Studies

Playwright and social critic George Bernard Shaw observed that “If you laid all the economists in the world end-to-end, they still would not reach a conclusion”. A new controversy involving the modeling of climate change-related risk confirms the veracity of Shaw’s observation once again. The controversy is about how to best model these risks. Two new papers, released within days of each other, both claim that the models being used to assess the potential impact of climate change on the economy and financial markets are seriously flawed, as they grossly underestimate the potential size of those impacts.

Reading through Carbon Tracker’s “Loading the DICE Against Pensions” and Institute and Faculty of Actuaries, University of Exeter’s “The Emperor’s New Climate Scenarios”, the messages are very similar:

- Pension funds are relying on economic research that ignores critical scientific evidence about the financial risks embedded in a warming climate.

- This flawed research suggests that +2to4C global warming will only have minimal impact on asset performance.

- These economics-based findings contrast sharply with findings in refereed science-based studies that global warming of even +1C will likely trigger ‘tipping points’ with material negative economic consequences.

- This serious disconnect between economics-based and science-based expectations sets the stage for a consequential wealth-damaging financial markets correction which is a scenario not currently being considered by many pension funds.

- Climate change must be treated as a potentially existential threat to the economy and financial markets, and not as a risk/reward trade-off subject to economic cost-benefit analysis.

- Achieving this change in mindset will require that all involved: model-providers, professional advisors, regulators, those in governance and management positions in pension/investment organizations, need break down current silos and develop common understandings of the nature and consequences of climate change-related risks.

- Time is too short to wait for perfect models. The key is to find workable solutions that realistically capture key risk drivers and their plausible interactions between policy, technology, the economy, and financial markets.

The goal of this Letter is to describe the current ‘Economics-Science Disconnect' problem and to lay out the path to overcoming it.

Understanding the ‘Economics-Science Disconnect’ Problem

To fix the ‘Economics-Science Disconnect Problem’ requires understanding why it exists. The two studies provide examples:

- A commonly-used economic model that integrates rising temperatures and GDP growth is the ‘Dynamic Integrated Climate Economy’ (DICE) Model. It projects a 21x increase in global GDP over the next 200yrs. if the average global temperature is stable. However, if the average temperature keeps rising as it has been, DICE projects that the GDP increase would ‘only’ be 17x today’s level. A key assumption here is that many industries will not be economically affected by rising temperatures.

- However, DICE ignores changes in precipitation as temperatures rise. This dynamic is captured by science-based Oceanic Circulation Models. Temperature-related changes in oceanic circulation patterns (e.g., due to melting ice at the North and South Poles) will have dramatic impacts on precipitation patterns, which in turn will have dramatic impact on farming and food production. For example, an Oceanic Circulation Model projection produced a long-term reduction of arable land from 20% to 7% of the planet if average temperatures continue to rise.

- Another reason for the smooth, steady, benign climate change impact projections made by commonly-used economic models is that they convert cross-sectional, point-in-time temperature/GDP differences (e.g., between Northern and Southern Europe) into through-time differences. There is no scientific basis for doing this. Nor is there any scientific basis for using a quadratic economic damage prediction function (i.e., damage increases by the change in average temperature squared). More plausibly, in the presence of ‘tipping points’, damage will increase exponentially as average temperatures rise.

- Simply reading today’s top news stories confirm the veracity of what climate models have been telling us: rising frequency and velocity of hurricanes/typhoons/tornadoes, rising frequency and impact of both floods and droughts, rising frequency and size of wildfires around the world, declining ground water levels, falling food production in many areas around the world, and yes, even Emperor penguins running out of South Pole ice to live on. These occurrences suggest we are experiencing exponential ‘tipping point’ experiences rather than ones governed by smooth, dynamically steady rules set by economists.

So, where to from here?

Start with Stories, not Numbers

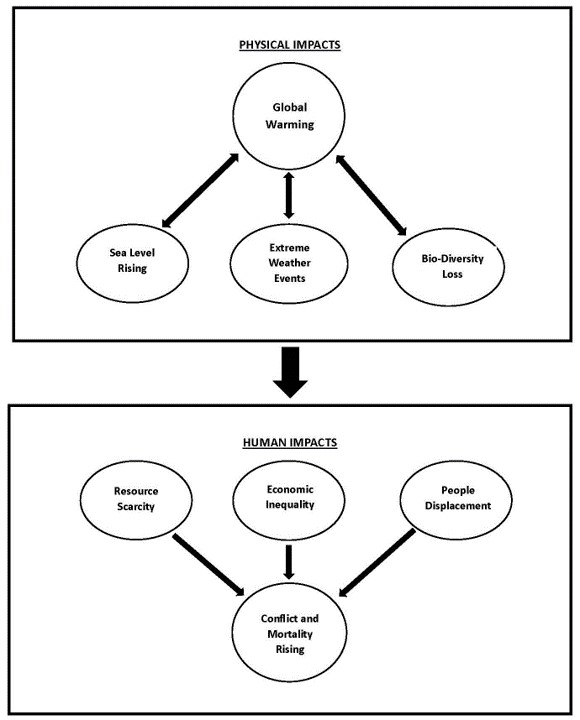

The two studies on modeling climate-related risks that this Letter discusses lead to an important conclusion: story first, numbers later. Figure 1 below makes the point. The story starts with scientists telling us that the accumulation of carbon emissions is causing global warming, and that global warming in turn is causing rising sea levels, extreme weather events, and biodiversity loss. These developments in turn lead to resource scarcity (food, water, fuel shortages), rising economic inequality, and people displacement…. which in turn trigger rising local and global conflict and mortality rates.

Figure 1 The Global Warming Story

With this ‘science-based reality story’ in place, obvious quantitative questions follow:

- If we are in a +1.5C scenario today, how quickly will temperatures rise from here?

- How will alternate ‘rising global warming rate’ scenarios impact sea levels? Extreme weather events? Biodiversity losses?

- How will these changes in turn impact resource scarcity, economic inequality, and people displacement around the world?

- At what temperature do we cease to function as a society?

“The Emperor’s New Climate Scenarios” Paper ended by reflecting on these profound questions.

Closing Reflections

Specifically, the Paper states:

“The pace of global warming from here is uncertain. Some scientists now estimate warming of 0.3C per decade, or around +1C every 30 yrs. This implies warming of greater than +2C by 2050 and +3C by 2080. This is well within the life expectancy for many people in pension plans now.

Put another way, at what point do we expect 50% GDP destruction – somewhere between 2070 and 2090 depending on how you parameterise the distribution. It is worth a moment of reflection to consider what sort of catastrophic chain of events would lead to this level of economic destruction.

This analysis provides a compelling logic for ‘Net-Zero’ becoming a part of fiduciary duty, as if we do not mitigate climate change, it will be exceptionally challenging to provide financial returns.”

Given the Paper’s analysis and conclusions, its caution that “If we do not mitigate climate change, it will be exceptionally challenging to provide financial returns” seems an understatement. Reverting back to this Letter’s opening quote, the Titanic did in fact sink after hitting the iceberg, and many lives were lost. If we are to prevent global warming from becoming the global Titanic of the 21st Century, urgent ‘Net-Zero’ actions are required now, including by pension fiduciaries. Scientific evidence strongly indicates that failing to do so would have a material negative impact on our future ability to pay pensions, and hence constitute a clear breech of fiduciary duty.

Keith Ambachtsheer

KPA Advisory Services is pleased to share this edition of The Ambachtsheer Letter with all readers; if you wish to become a KPA Advisory Client/gain access to ALL Letters, please see the Services page on our website.

The information herein has been obtained from sources which we believe to be reliable, but do not guarantee its accuracy or completeness.

Advisory Service clients have access to full issues of the Ambachtsheer Letter.

Become an Advisory Service Clientor Login